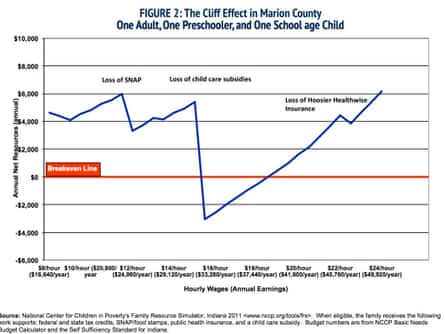

Here's the paradox of the minimum wage: even as the higher minimum wage attempts to lift low-wage workers out of poverty and help them get off benefits, it might actually leave them worse off than before. The reason? The few extra dollars tacked onto their pay checks cause them to lose their federal benefits, including food stamps or housing subsidies.

For example, a wage of about $11 to $12 can cost a single mother with two children their food stamps, also known as Snap benefits. A wage of about $15 to $16, similar to the minimum wage recently enacted in Seattle, can leave that same family without any childcare benefits.

"This is a big issue with deciding [social] programs, because you want the programs to be targeted towards the people that most need them," explains Curtis Skinner, director of family economic security at National Center for Children in Poverty. "On the other hand, you don't want to create this disincentive, which is possible, to earn more or to take a promotion."

It's the benefits cliff, and it's very real.

"There is this issue of the benefits cliffs, where some programs are designed so just a very marginal increase in earnings can result in a loss of a very important benefit. And a lot of states, unfortunately, have structured their childcare subsidies programs that way," explains Skinner.

"Typically, pay rises, income rises, but at some point you lose eligibility for a subsidies all together and it's an abrupt reduction in that family's resources," Skinner says.

In the world of benefits, nuclear families are far from the norm. Very often, the benefits are calculated on the income of a single breadwinner – usually a mother.

A single mother with two children is "a common family type, it's not an anomaly at all," explains Derek Thomas, a senior policy analyst at the Indiana Institute for Working Families.

Minimum wage wars: $10.10 v $15

The current proposal in Washington to increase the national minimum wage to $10.10 would help families keep their benefits.

"Such families would retain these benefits at $10.10," explains Skinner. "Families would also qualify, most importantly, for childcare subsidies at this level of income."

Increasing minimum wage, however, affects the pay of all low-wage workers.

It's the $11 to $11.50 hourly wage where families begin to lose their Snap benefits, says Thomas.

The higher the minimum wage gets, the less in benefits the family is eligible to receive.

"Raising minimum wage to $15 an hour, you also have the same problem with childcare in Indiana. Because going from $15 to $15.50, you lose almost $9,000 in childcare benefits in Indianapolis," explains Thomas.

The problem is not unique to Indiana. A higher minimum wage improves a family's financial situation, but too often, not by enough.

"In many places, $15 minimum wage would still be too low to make ends meet for a family of three in large cities," says Skinner. "The big issue is that it could cause some families to lose childcare subsidies – well over $10,000 a year. The families would have to balance the tradeoff between the wage increase and losing the childcare subsidies if they need them."

Childcare is the most expensive benefit to lose.

Living wage

How to fix this is the thorny issue.

"The minimum wage is not the way to go," says Skinner, pointing out that by the time it's finally implemented, it's likely the wage will be once again outdated.

Considering all this, advocates have begun calling for a move away from the minimum wage and the adoption of something called a living wage. Or as Thomas puts it, a self-sufficient wage.

"Everyone likes the idea of self-sufficiency," Thomas says. When earning a self-sufficient wage, a mom with two kids wouldn't need to rely on any governmental assistance to make ends meet.

"The math is clear. We need to bring [minimum wage] up to living wage so that we spend less on benefits. That's the goal," says Susan J. Roll, an assistant professor at the School of Social work at the California State University in Chico. "No one wants to live on benefits."

The last bill to increase the federal minimum wage was passed in 2007. Increasing minimum wage to the proposed $10.10 in the current US political climate seems difficult enough. Moving to a living wage might well be impossible.

Unfortunately, calculating a living wage is no easy task. A self-sufficient wage would not be the same for all areas in the US. It can also vary significantly across counties of any given state.

While the self-sufficient wage in Indianapolis is $19, there are other counties where it's even higher, notes Thomas, adding that in some places it's as high as $22 an hour.

There is a reason why the gap between the current minimum wage and the living wage is so high. "The wages have remained basically the same and the cost of goods has increased," explains Thomas.

Bringing the issue back to the communities

As a result, many state and local governments have taken the matters into their own hands. Recently, Seattle raised their minimum wage to $15 an hour. Chicago is mulling doing the same.

When considering an increase in minimum wage, states should also revisit the issue of their benefit eligibility levels, says Thomas. "That's a good time for states to deal with both issues at the same time."

Comments (…)

Sign in or create your Guardian account to join the discussion