Bay Area Real Estate Market Update

Bay area real estate during the first half of 2023 saw a marked increase in listings going into contract with days on market decreasing.

This was driven mainly by 3 factors.

1. Historically low inventory;

2. Nasdaq index increasing significantly;

3. Buyers trying to lock in homes at current rates and refinance later;

Low Inventory

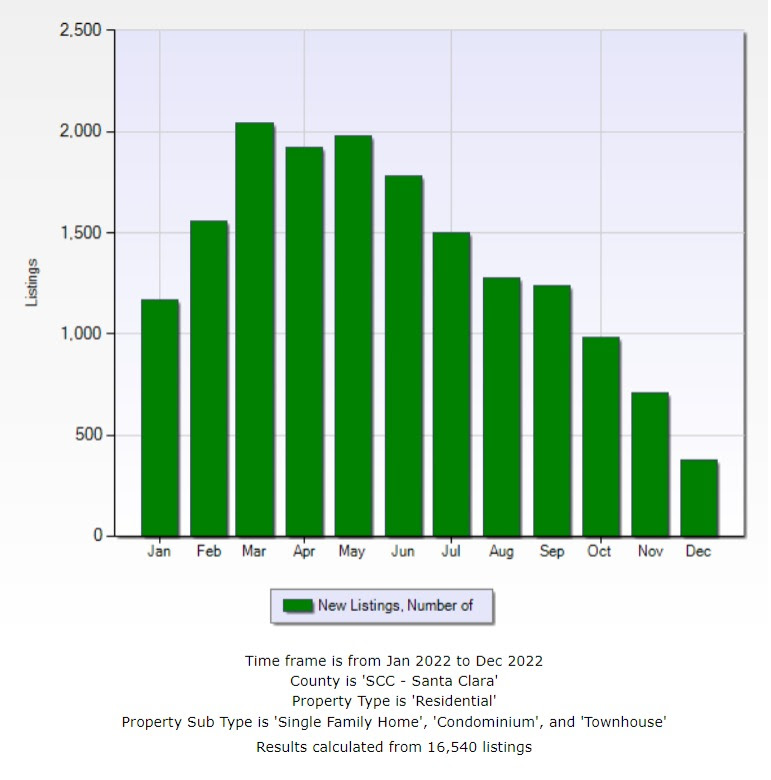

The total number of new homes listed in Santa Clara County through May of 2022 was approximately 8,669.

In 2023, this number stood at 5,443 during the same time period, representing a nearly 37% decrease in the number of available homes for sale. New housing has also lagged demand for several years due to strict building codes and local regulations, further constraining supply.

Nasdaq Increase

The Nasdaq composite index, which tracks the stock prices of most major technology companies, increased by over 31% year-to-date as of June 2023. As the Bay Area is dominated by large tech companies, homeowners here are significantly affected by the Nasdaq index. A large portion of Bay Area buyers rely on stock compensation granted as part of their pay packages, meaning an increase in the stock of their company typically equates to an increase in their ability to afford homes.

Interest Rates

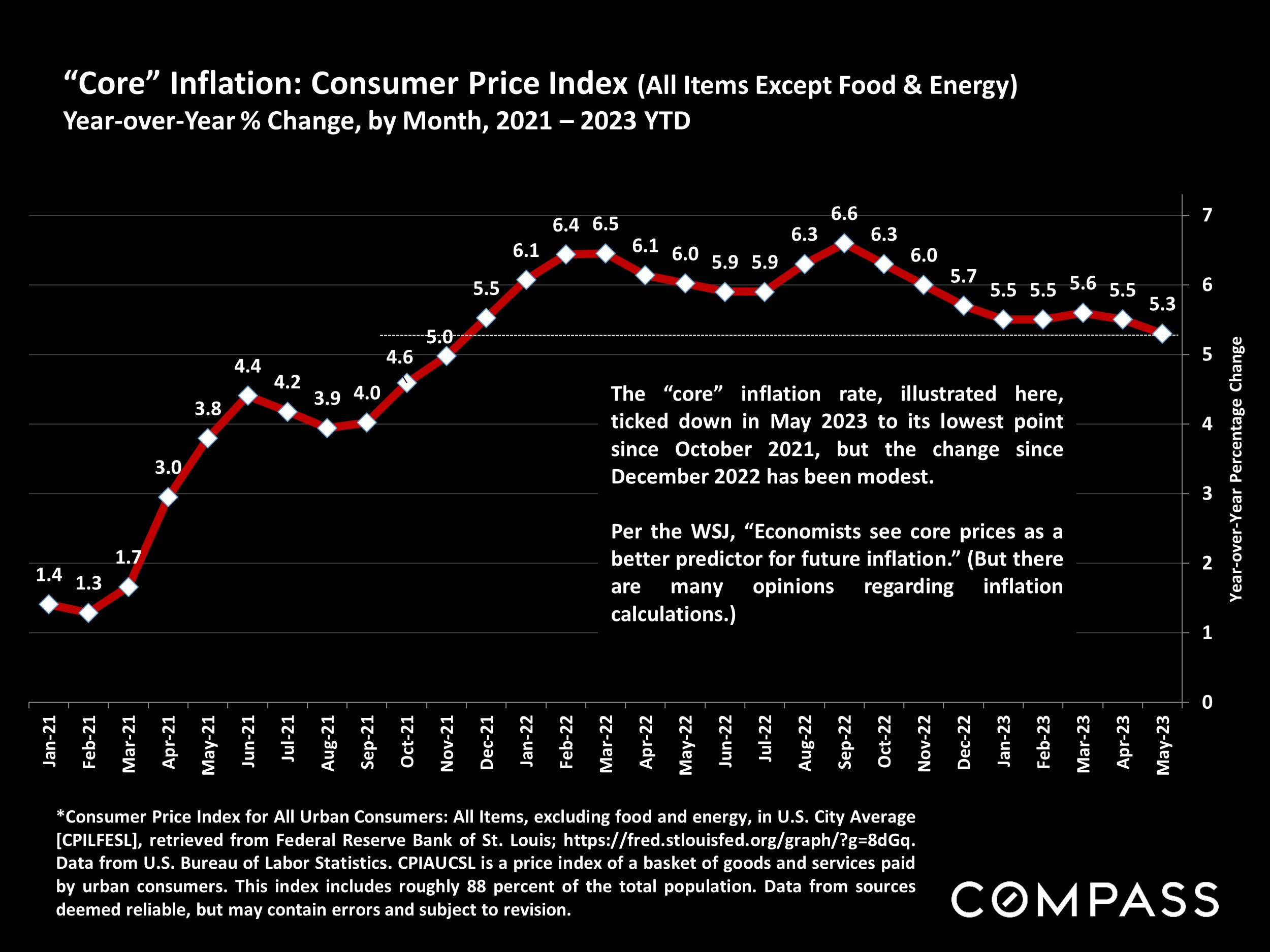

While interest rates remain high relative to the low rates experienced over the past 5 years, many buyers are anticipating that rates will drop over the next year or so if inflation subsides. Anecdotally, we have heard that many buyers are attempting to lock in a house in the current interest rate environment as the home buying competition may increase even more if rates drop further due to lack of supply.

Although inflation is currently running at around 5%, it has been steadily trending downwards. As the federal reserve’s optimal inflation target is around 2%, it may lower interest rates once this target is achieved and exacerbate demand.

Quick Take

The Bay Area real estate market is currently in a state of flux. Low inventory, rising stock prices, and anticipation of lower interest rates are all contributing to increased demand and rising prices. It remains to be seen how the market will evolve in the second half of 2023, but for now, it is a seller’s market with strong demand and limited supply.

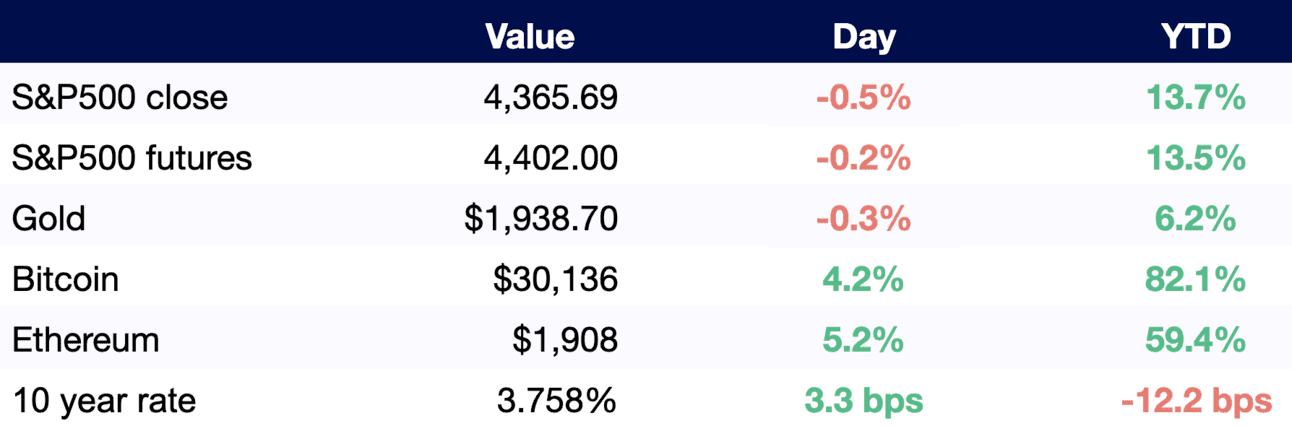

Today’s Numbers