Lifestyle

Retirable surveyed more than 2,000 Americans aged 55 and older to determine key sentiments related to retirement in 2023.

John Thomas Lang

•

Published February 28th, 2023

Table of Contents

Key Takeaways

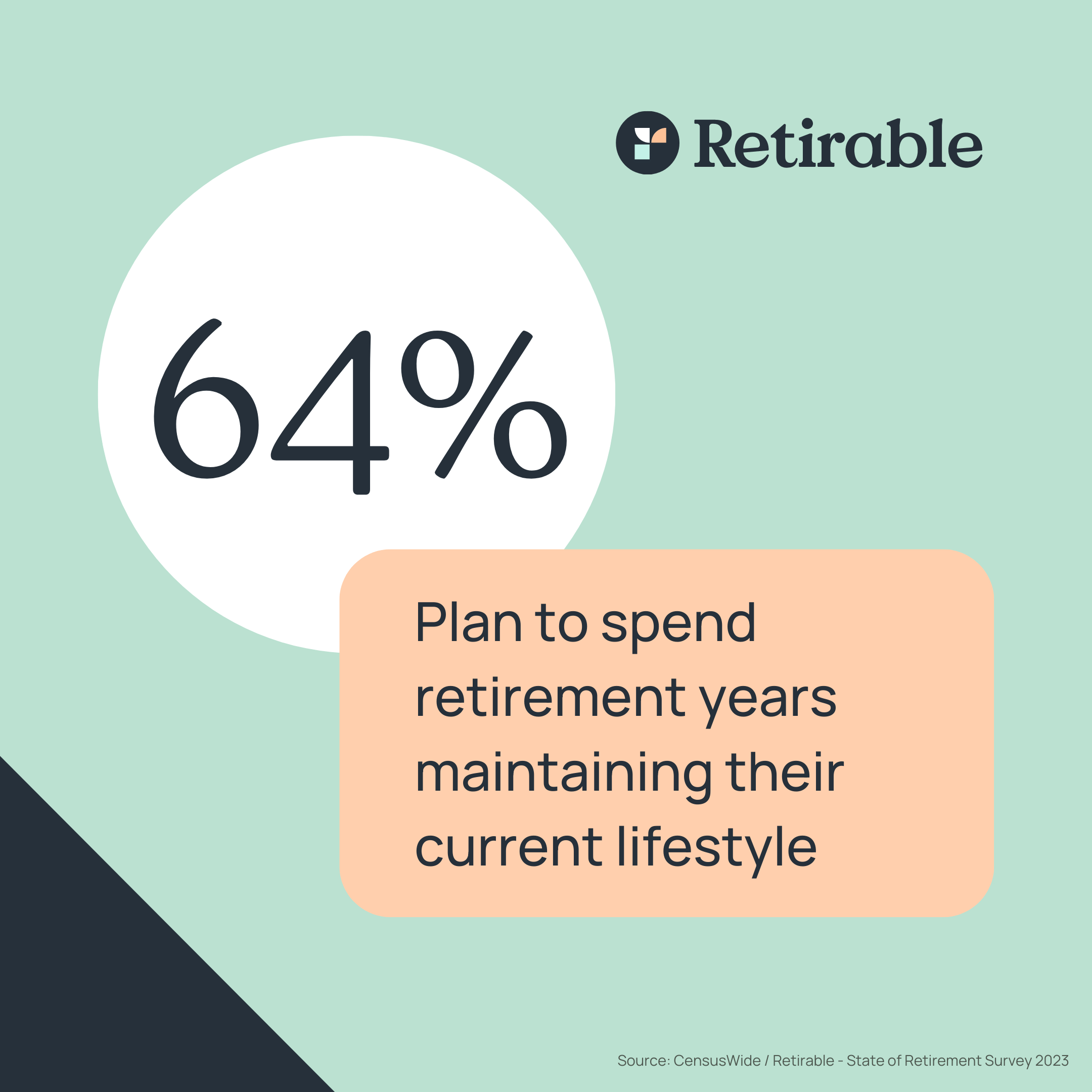

More than 3 in 5 (64%) respondents plan to spend/are spending their retirement years maintaining their current lifestyle. Only about 1 in 8 (13%) plan to split time in a vacation home and their main property, while only 8% plan to travel.

More than two-thirds (67%) of respondents have not met with an advisor to create a financial plan, and less than one third (31%) have.

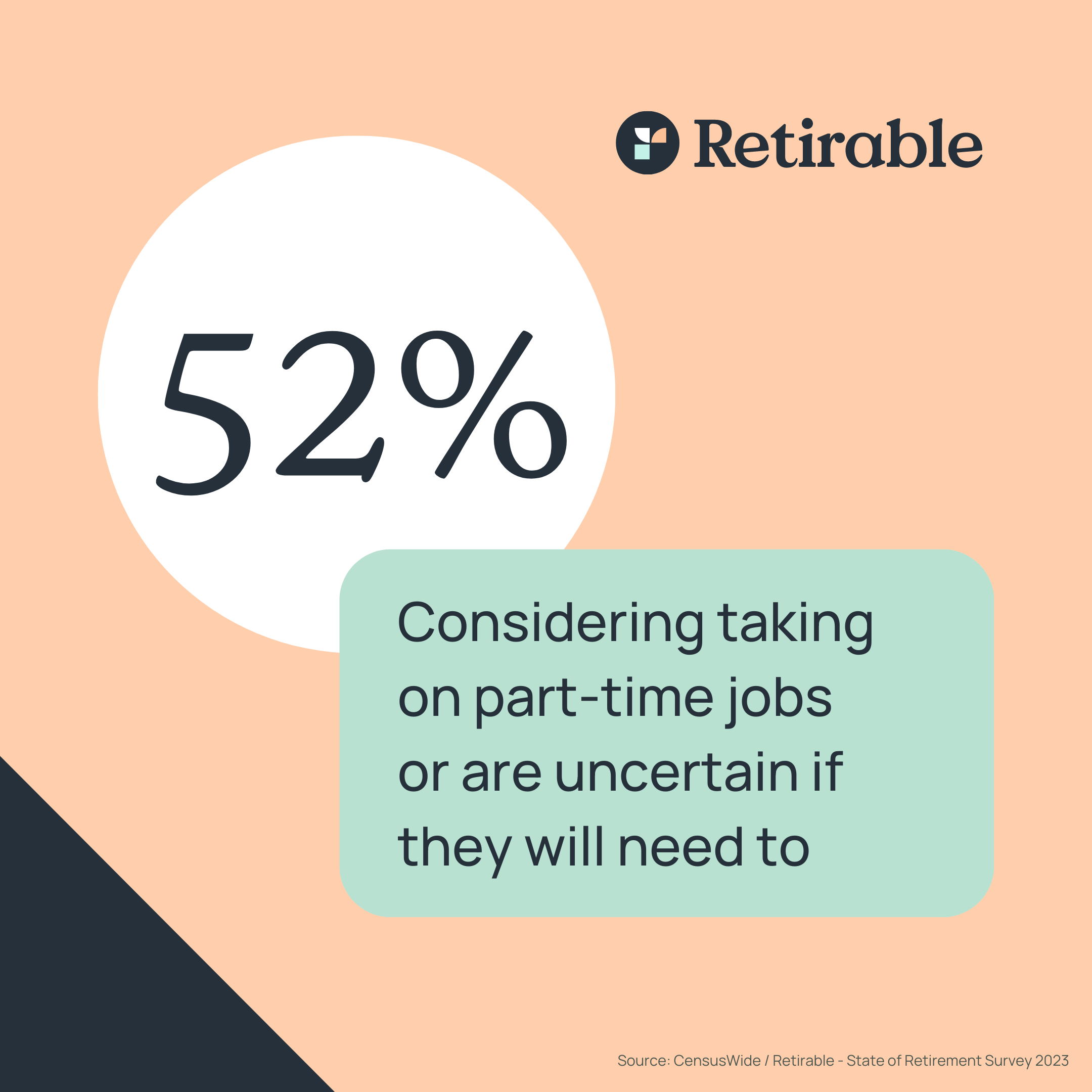

More than half (52%) of respondents are considering taking on part-time jobs, or are uncertain if they will have to.

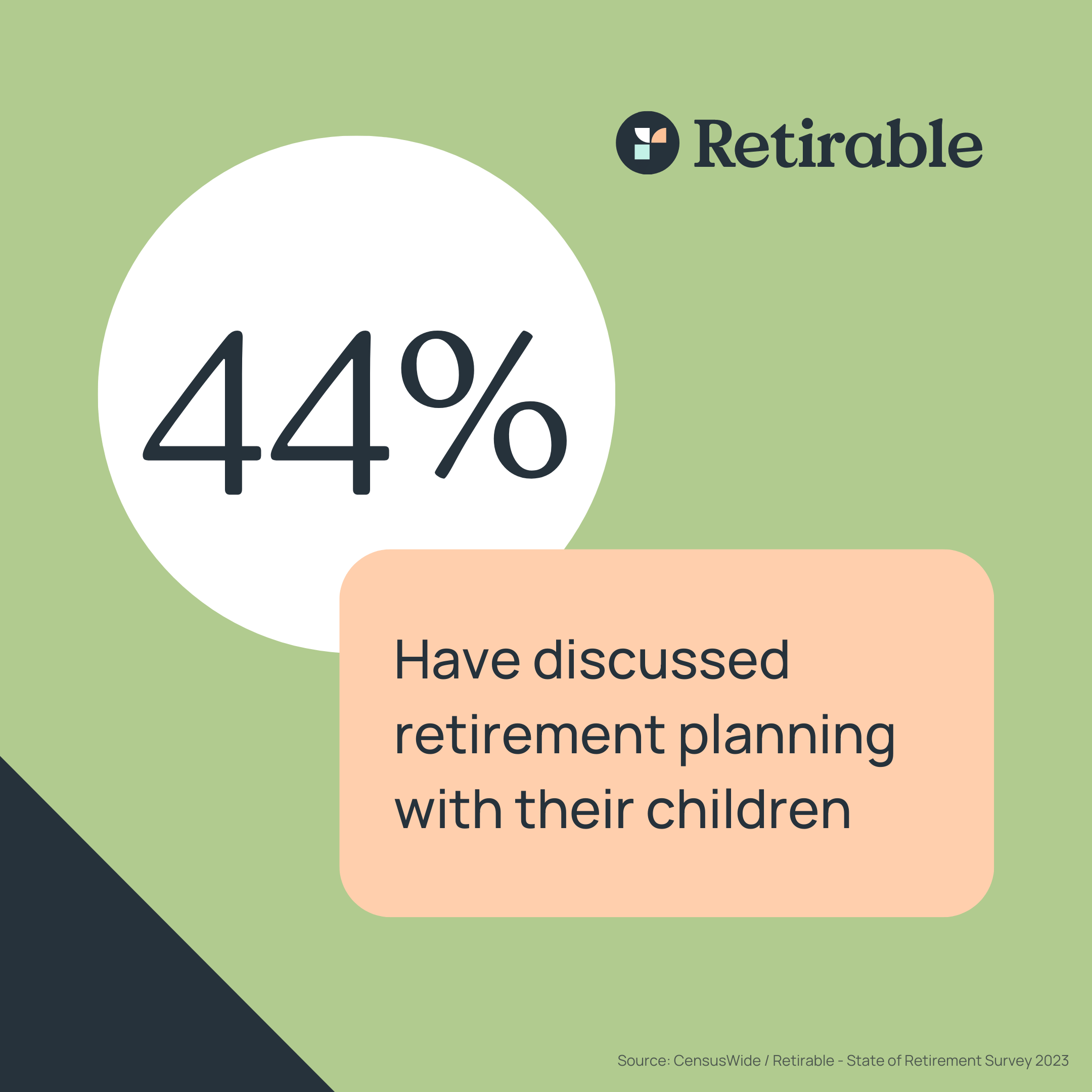

Less than half (44%) of Americans have discussed retirement planning with their children—and only 15% plan on doing so.

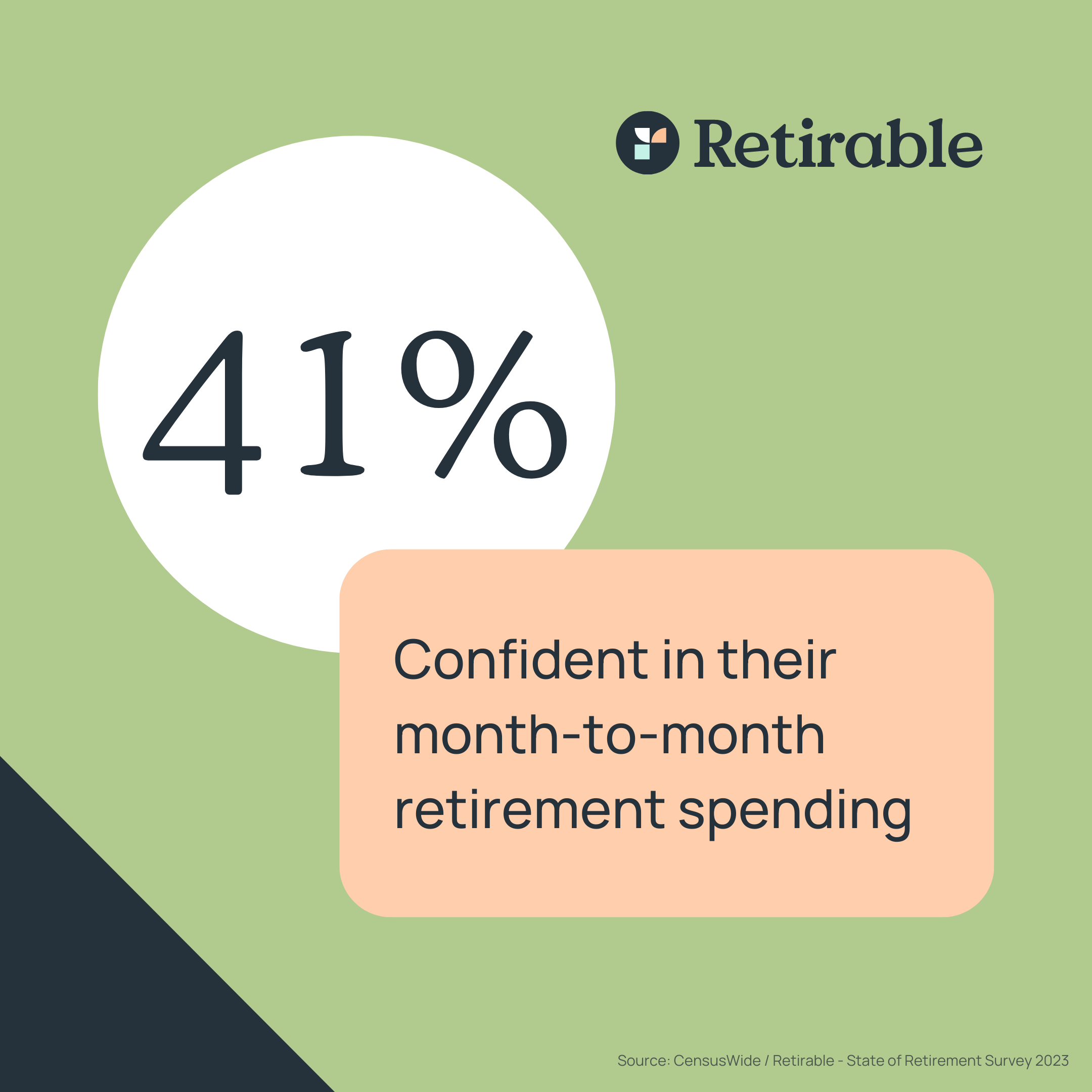

4 in 10 (41%) of near retirees are confident in their month-to-month spending in their current state and moving into retirement.

By 2030, The United States will have more adults aged 65 years or older than children under the age of 18. This would be the first time in the nation’s history, according to The U.S Census Bureau. This transformation will mark a seachange for the nation, evolving how it transitions its workforce into retirement, funds vital programs like Medicare and Social Security and how retirees themselves will spend their golden years.

In these next seven years, all Baby Boomers and approximately one-fifth of the U.S population will reach the traditional retirement age of 65. With these monumental shifts in our population on the horizon, the need for retirement innovation is clear.

Retirable is on a mission to empower a confident, worry-free retirement for everyone. In order to better serve our current and future clients, we set out to better understand The State of Retirement in 2023. Here’s how we did it.

Our Methodology

Retirable, in partnership with CensusWide, conducted an online survey between January 10-17, 2023. Survey respondents included 2,050 participants, of all genders, across the United States. Participants were all over 55 years old, and the survey did not include ultra high net worth individuals.

We curated a series of questions with following focus areas in mind:

- How individuals are spending their retirement

- Healthcare, housing and expenses

- Savings, spending and advisory

- Preparing the next generation

How individuals are spending their retirement

Oftentimes, retirement is seen as a time when retirees want to travel, move, or make big life changes. However, our survey found that retirees are looking to maintain their lifestyles into their retirement years, with a minority of respondents expressing a desire to move. This pattern might be tied to evolving expectations as individuals get older, given more respondents aged 75+ plan to forego moving or traveling, while those between ages 55-64 expect to prioritize travel in their retirement years.

Overall, respondents believe they will retire by the age of 68. Despite female respondents expressing they have a smaller retirement savings fund in comparison to male respondents, more women believe they are likely to retire before their male counterparts.

The survey also revealed that individuals' expectations of when they will retire shift as they age, with individuals anticipating to retire later as they get older. This is linked with demographics as female respondents were more likely to not have a plan for retirement than male respondents (22% vs 17%), and single people also fell behind their married counterparts in retirement planning (29% vs 16%).

Survey Data

- 7 in 10 (69%) respondents aged 75-84 plan to spend/are spending their retirement years maintaining their current lifestyle, whereas just under 3 in 5 (59%) of those aged 55-64 said the same.

- On average, male respondents currently have $367,125 saved for their retirement, whilst female respondents have $257,593.

- On average, male respondents believe they will retire at age 70, whilst female respondents believe they will retire at 67.

- On average, respondents aged 75-84 believe they will retire at age 80, compared to respondents aged 55-64 who believe they will retire at age 65.

Healthcare, housing and expenses

Respondents are largely aware of how to access and take advantage of vital programs, such as Medicare and Social Security. This is good news, as the majority of respondents anticipate healthcare to be their largest expense during retirement. Given the current state of the economy, many individuals also showed concern that the cost of living as well as mortgage/rent would also likely be one of their largest expenses during retirement.

Survey Data

- More than 2 in 5 (44%) respondents anticipate healthcare to be the largest expense during their retirement years.

- 2 in 5 (40%) respondents anticipate living/lifestyle costs to be the largest expense during their retirement years.

- A third (33%) of respondents anticipate mortgage/rent to be the largest expense during their retirement years.

- More than 2 in 5 (46%) respondents aged 75-84 anticipate living/lifestyle costs to be the largest expense during their retirement years, whilst 2 in 5 (40%) of those aged 55-64 said the same.

Savings, spending and advisory

A very small percentage of respondents in the pre-retirement group (ages 55-64) reported confidence in their current month-to-month spending and saving. Despite these low confidence levels, a majority have not considered meeting with an advisor to address their concerns. The likelihood of having met with an advisor increases based on the age of the respondent, with over a third of respondents aged 75+ reporting they have met with an advisor, compared to under a quarter of those aged 55-64. This could very likely be due to the inaccessible nature of traditional financial advisors.

On average, respondents currently have $310,530 saved for their retirement, and believed that they would need about $873,000 to retire comfortably. One-third reported that they do not yet have enough money to last through retirement. This doesn't necessarily indicate that two-thirds of respondents have reached their financial goals. However, this does signify that at their current state, with the addition of entitlement benefits, and with potential income from a part-time job, they are confident in their savings lasting through retirement years.

Survey Data

- More than half (55%) of respondents aged 75-84 are confident with their current month-to-month spending, whilst just under 3 in 10 (29%) of those aged 55-64 said the same.

- Nearly 2 in 5 (37%) respondents feel like they have enough money to last them through retirement, whilst more than a third (35%) do not feel they have enough money to last them through retirement.

- Of respondents who reported interest in having a part-time job during retirement, 7 in 10 (71%) are seeking extra income outside of retirement savings and two-thirds (65%) want to stay busy/active, while a quarter (25%) want to continue growing retirement savings.

Preparing the next generation

As retirees age, they are communicating more with their children about their retirement planning — a shift away from previous sentiments that have shown parents do not typically involve their children in financial discussions. Furthermore, parents reaching their retirement years are making sure the next generation is set for retirement despite a general lack of confidence in their own retirement planning. Despite having more conversations with their children about retirement, respondents are more likely to leave assets for their children (47%) than they are to contribute financially to their child’s retirement plan (6%).

Survey Data

- About 3 in 5 (59%) respondents said they have discussed how to start planning for retirement with their child(ren), with 15% reporting they have had several conversations about it.

- Another 15% of respondents claim they are planning to have this discussion, but have not done so yet.

- Nearly a quarter (24%) of respondents have consulted their child(ren) about their finances and/or retirement plans.

- 3 in 5 (59%) respondents claim they would trust a recommendation from their child(ren) about what to do with their finances as well as who to see or what company to seek out assistance from. Women are slightly more likely to trust a financial recommendation from their child(ren) in comparison to men (62% v. 55%).

In Conclusion

Retirement is looming for millions of Baby Boomers in 2023 and many are feeling uncertain about retiring in this economy. However, there are key indicators that show optimism as we head towards a future where the ratio of working-age adults to retired-age adults will be at an all-time low.

In 2020, The Census Bureau found that The United States had 3 ½ working-age adults for every retirement-age adult. The bureau estimates that by 2060, there will be 2 ½ working-age adults for every retirement-age adult. This shift will fundamentally change how we take care of our aging population over the next few decades, and should be a major priority for the U.S. government and citizens alike.

Retirable was founded to empower a confident, worry-free retirement for everyone. With expert-led planning, client-focused features and customized ongoing care of an advisor, every retiree gains the control, clarity and confidence they need in retirement. Our planning, investing and spending tools will guide your path before and through retirement. Get started today with a FREE Retirable consultation. See what’s possible for your retirement.

Share this advice

JT is currently VP, Marketing at Retirable. A proud Colorado Native now calling Chicago home, he has played a key role in scaling multiple $1B+ unicorn tech startups. In addition to his passion for improving financial wellness in his community, you can probably find JT digging through crates for vinyl records.

Share this advice

JT is currently VP, Marketing at Retirable. A proud Colorado Native now calling Chicago home, he has played a key role in scaling multiple $1B+ unicorn tech startups. In addition to his passion for improving financial wellness in his community, you can probably find JT digging through crates for vinyl records.

Free Retirement Consultation

Still have questions about how to properly plan for retirement? Speak with a licensed fiduciary for free.